Stephens-Hosted Expert Call with Strategic Health Group

Dennis Eder

Posted: December 9, 2020

![]() [Printable Version]

[Printable Version]

Healthcare: Healthcare Services

Reason for Report: Recap of Conference Call

Takes from Expert Call w/Strategic Health Group on MA and Managed Medicaid

INVESTMENT CONCLUSION:

The government programs markets will represent the primary source of Managed Care enrollment growth in the years to come, led by Medicare Advantage (MA), which has the strongest secular growth prospects. COVID has impacted the MA and Managed Medicaid markets in a variety of ways, both positive and negative.

In MA, market growth will remain robust at 10%+ in 2021. The annual enrollment period (AEP) has also shown higher levels of persistency; existing members were hesitant to switch plans during the pandemic. This dynamic benefits the established incumbents with leading market share, such as UNH and HUM, despite increased competition, including from MA “start-ups”.

In Managed Medicaid, visibility into organic growth for 2021 remains cloudy given potential for states to re-implement eligibility determinations, currently suspended during the pandemic. Medicaid MCO reimbursement rates also could remain tight in FY2021-FY2022 given ongoing state budget pressures, creating constraints for incremental Medicaid margin expansion.

KEY POINTS:

Stephens-Hosted Expert Call Participants. We hosted an expert call with Strategic Health Group, a health care consulting firm focused on the government programs market. Participating from SHG were Hank Osowski (Managing Partner) and Dennis Eder (Managing Partner). Key topics we discussed on the call consisted of the latest outlook for Managed Medicaid and Medicare Advantage, as well as the impact of COVID and the 2020 elections on health plan market fundamentals and policy.

Developing Trends in Medicare Advantage

We continue to see increased competition in the Medicare Advantage(MA) market as new start-ups enter the market and grow their geographic footprints. The established MA market leaders also continue to invest heavily in geographic expansion and providing more competitive plan benefits in existing markets.

As the MA market continues to mature, with penetration rates surpassing 40% of eligible Medicare beneficiaries in 2020, the focus of major plans has also shifted to customer retention, reflecting the scale advantages of incumbency as well higher member persistency during the pandemic.

Still, there are significant organic growth opportunities ahead as the Medicare-eligible population continues to grow a ta rapid pace, and the MCOs continue to drive higher MA market penetration. Therefore, we expect to see continued significant investments in MA geographic plan expansion in coming years. We are also seeing an enhanced focus on data informatics and analytics capabilities, which together with robust provider networks, attractive plan benefits,and strong customer service, helps to drive higher STARS scores for MA plans. This allows MA plans to capture higher reimbursement rates and drive driven incremental top-line growth through market share gains by offering more competitive benefits.

The data analytics and informatics capabilities for MA plans will also be of utmost importance as plans begin to determine rates for the 2022 plan year given the disrupted utilization patterns and lack of ability to fully capture risk score data during the COVID pandemic.

Developing Trends in Managed Medicaid

Throughout 2020, we have seen the loss of employer-sponsored (ESI) coverage and the suspension of eligibility redetermination efforts drive significant increases in Medicaid enrollment. At the same time, COVID-19 has continued to disrupt state tax revenues which has put increased pressure on state budgets in 2020, many of which were already facing pressure from growing long-term Medicaid costs. As a result, a number of states have looked to reduce rates for Medicaid MCOs, and have considered provider reimbursement cuts as well. While Medicaid plans will look to supply risk score data and argue for actuarial soundness to defend current rate levels, Medicaid managed care rates could remain under pressure over the next couple of fiscal years, creating a relatively challenging climate for margin expansion for Medicaid MCOs in FY2021-FY2022.

COMPANIES MENTIONED

Strategic Health Group (Private)

APPENDIX A

ANALYST CERTIFICATION

The analyst primarily responsible for the preparation of the content of this report certifies that (i) all views expressed in this report accurately reflect the analyst’s personal views about the subject company and securities, and (ii) no part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the analyst in this report.

REQUIRED DISCLOSURES

The research analyst principally responsible for preparation of this report has received compensation that is based on the firm’s overall revenue which includes investment banking revenue.

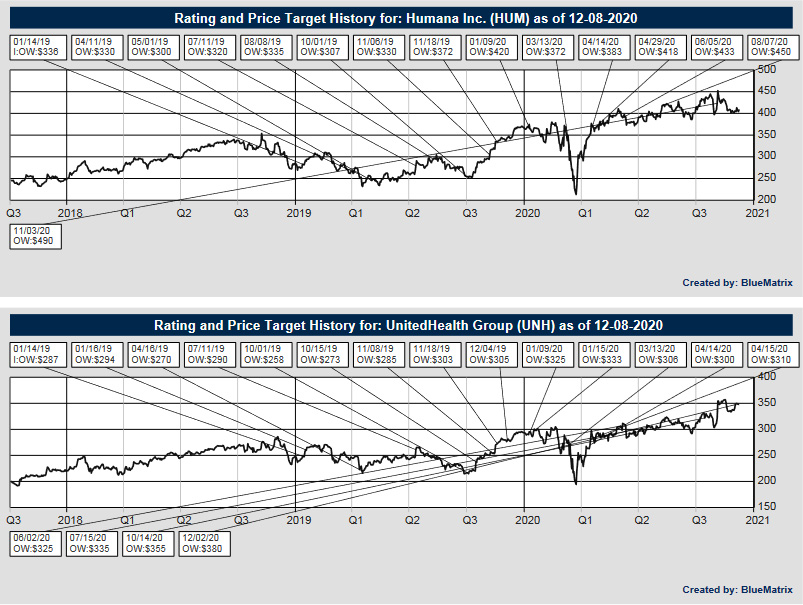

Stephens Inc. maintains a market in the common stock of Humana Inc. as of the date of this report and may act as principal in these transactions.

Humana Inc. is or has been a client of Stephens Inc. for non-investment banking securities related services within the past 12 months.

An affiliate of Stephens Inc. has received compensation for insurance agency/brokerage services provided in connection with insurance contracts issued by Humana Inc.

Stephens Inc. maintains a market in the common stock of UnitedHealth Group as of the date of this report and may act as principal in these transactions.

An affiliate of Stephens Inc. has received compensation for insurance agency/brokerage services provided in connection with insurance contracts issued by UnitedHealth Group.

Valuation Methodology for Humana Inc.

We value HUM based on the P/E valuation metric and our 2021E adjusted EPS.

Risks to Achievement of Target Price for Humana Inc.

- HUM’s growth prospects and competitive position in the Part D market have diminished over the past several years.

- HUM has left the door open to pursuing a potentially large acquisition in Medicaid. Whenever HUM has ventured out from its Medicare moat, bad things have tended to initially happen to the stock.

- Increased competition from pricing and new entrants in the Medicare Advantage market represents a risk to HUM’s core business line.

- Medicare for All and public option legislation at both the state and federal level.

Valuation Methodology for UnitedHealth Group

We value UNH based on the P/E valuation metric and our 2022E adjusted EPS.

Risks to Achievement of Target Price for UnitedHealth Group

- The growth and margin performance of the core Medicaid business has been lackluster in 2018-2019.

- UNH could see increased competition in Commercial and Medicare from its national MCO peers, should they redeploy anticipated merger synergies (CI & CVS) and PBM savings (ANTM) to drive price-based share gains.

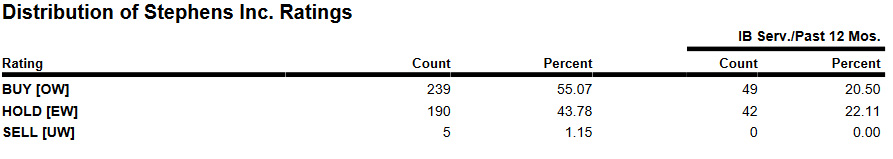

Ratings Definitions

OVERWEIGHT (O) – The stock’s total return is expected to be greater than the total return of the company’s industry sector, on a risk-adjusted basis, over the next 12 months. EQUAL-WEIGHT (E) – The stock’s total return is expected to be equivalent to the total return of the company’s industry sector, on a risk-adjusted basis, over the next 12 months. UNDERWEIGHT (U) – The stock’s total return is expected to be less than the total return of the company’s industry sector, on a risk-adjusted basis, over the next 12 months. VOLATILE(V) – The stock’s price volatility is potentially higher than that of the company’s industry sector. The company stock ratings may reflect the analyst’s subjective assessment of risk factors that could impact the company’s business.

OTHER DISCLOSURES

Certain investment programs offered by Stephens to clients sometimes engage in purchases or sales of securities that are consistent or inconsistent with Research Analyst recommendations. These programs are managed on a discretionary basis, or provide investment recommendations, by program managers in the exercise of their independent judgment and analysis. Stephens’ directors, officers and employees are allowed to participate in these programs subject to established account minimums and applicable compliance restrictions.This report has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material.Information included in the report was obtained from internal and external sources which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the report, and all expressions of opinion apply on the date of issuance of the report. No subsequent publication or distribution of this report shall mean or imply that any such information or opinion remains current at any time after the stated date of the report. We do not undertake to advise you of any changes in any such information or opinion. Additional risk factors as identified by the Subject Company and filed with the Securities and Exchange Commission may be found on EDGAR at www.sec.gov. Prices, yields, and availability are subject to change with the market. Nothing in this report is intended, or should be construed, as legal,accounting, regulatory or tax advice. Any discussion of tax attributes is provided for informational purposes only, and each investor should consult his/her/its own tax advisors regarding any and all tax implications or tax consequences of any investment in securities discussed in this report. From time to time, our research reports may include discussions about potential short-term trading opportunities or market movements that may or may not be consistent with Stephens’ long-term investment thesis, rating, or price target. Please note that we provide supplemental news and analysis in Quick Take blogs available to clients on our website. If applicable, when reading research on Business Development Companies, you should consider carefully the investment objectives, charges, risks,fees and expenses of the investment company before investing. The prospectus, and, if available, the summary prospectus,contain this and other information about the investment company. You can obtain a current prospectus, and, if available,a summary prospectus, by calling your financial consultant. Please read the prospectus, and, if available, the summary prospectus, carefully before investing as it contains information about the previous referenced factors and other important information. Also, please note other reports filed with the Securities and Exchange Commission by the relevant investment company at www.sec.gov.. Please also note that the report may include one or more links to external or third-party websites. Stephens Inc. has not independently verified the information contained on such websites and can provide no assurance as to the reliability of such information, and there can be no assurance that any opinions expressed on such websites reflect the opinions of Stephens Inc.or its management. Additional information available upon request.

See important disclosures and analyst certification on this report. To access current disclosures for other Stephens Inc. covered companies, clients may refer to https://stephens2.bluematrix.com/sellside/Disclosures.action.